The United States Junior Chamber

The United States Junior Chamber (Jaycees) gives people between the ages of 18 and 40 the tools they need to build the bridges of success for themselves in business development, management skills, individual training, community service, and international connections. The U.S. Junior Chamber is a nonprofit corporation/organization as described under the IRS code, Section 501.

Established in 1920 to provide opportunities for young men to develop personal and leadership skills through service to others, the Jaycees later expanded to include women, reflecting women’s growing influence and leadership in America.

For the past 100 years, Jaycees have been a force for good in America and worldwide. Jaycees helped establish AirMail services in America with Jaycee Charles Lindbergh and has raised millions of dollars for causes such as the Muscular Dystrophy Association and the March of Dimes. Our organization has built parks, playgrounds, hospitals, ball fields, and housing for the elderly while conducting service and support programs in thousands of communities nationwide.

Jaycees can be found in all walks of life: governmental leaders such as past Presidents Bill Clinton and Gerald Ford, business tycoons such as Domino’s Pizza mogul Tom Monaghan, a registered nurse, and former Miss America Kaye Lani Rae Rafko-Wilson, sports heroes like basketball great Larry Bird–name the field and Jaycees can be found at the forefront.

With the nation’s focus on volunteerism, from the smallest towns to the largest cities, the Jaycees are enlarging areas of opportunity for people.

Government Involvement

The United States Junior Chamber has a long history of impacting the nation through projects specifically directed at action and involvement with local, state, and national government agencies. From the original “Get Out the Vote” campaign in 1923 to ensure statehood for Alaska and Hawaii in 1959. In 1962 Jaycees also urged the adoption of the Uniform Vehicle Code, emphasizing state action resulting in national adoption. Jaycees have also used the skills and contacts made through Governmental Involvement projects to run for various elected offices, including the President of the United States.

The United States Junior Chamber and chapters across the nation encourage Americans to “Get Out the Vote.” Americans are given the freedom to choose which candidate to elect or whether to vote at all. An alarming number of citizens choose the second option, leaving only a handful of people to decide who will run our country. Through the exciting Get Out the Vote program, Jaycee chapters throughout the country will combine efforts in their communities to educate and encourage people to register and cast their votes on election day. Projects include candidate forums, voter registration campaigns, town hall meetings, and other projects designed to inform and educate the local electorate and encourage increased participation in the process of democracy

Citizen Corps

Citizen Corps Councils help drive local citizen participation by coordinating Citizen Corps programs, developing community action plans, assessing possible threats, and identifying local resources.

Citizen Corps asks you to embrace the personal responsibility to be prepared, get training in first aid and emergency skills, and volunteer to support local emergency responders, disaster relief, and community safety.

The Citizen Corps Affiliate Program expands the resources and materials available to states and local communities by partnering with Programs and Organizations that offer resources for public education, outreach, and training; represent volunteers interested in helping to make their community safer; or offer volunteer service opportunities to support first responders, disaster relief activities, and community safety efforts.

Citizen Corps is coordinated nationally by the Department of Homeland Security. DHS also works closely with the Corporation for National and Community Service (CNCS) to promote volunteer service activities that support homeland security and community safety. CNCS is a federal agency that operates nationwide service programs such as AmeriCorps, Senior Corps, and Learn and Serve America. Participants in these programs may support Citizen Corps Council activities by helping to establish training and information delivery systems for neighborhoods, schools, and businesses and helping with family preparedness and crime prevention initiatives in a community or across a region.

Securing our safety and freedom requires that we all work together. Every American has a critical role to play.

Legal Documents and Forms

The United States Junior Chamber is also committed to educating the community and ensuring that its members access the essential U.S. legal documents. People associate state and federal authorities, such as the Internal Revenue Service or Social Security Administration, with confusing bureaucratic red tape. However, it’s not hard to understand the procedures and obtain the relevant documents if you know where to look. We’ve gathered all the necessary official PDF forms and their explanations, so you could find the one (or more) that is suitable for you.

Internal Revenue Service (IRS) PDF Forms

The Internal Revenue Service (IRS) forms are official forms designed by the IRS to collect taxes, administer tax-related issues, and enforce federal tax laws. Below, you will find all the essential documents regarding individual and employment taxes and corporate, estate, and gift taxes. We’ve divided them into groups for your convenience.

Trusts and Estates

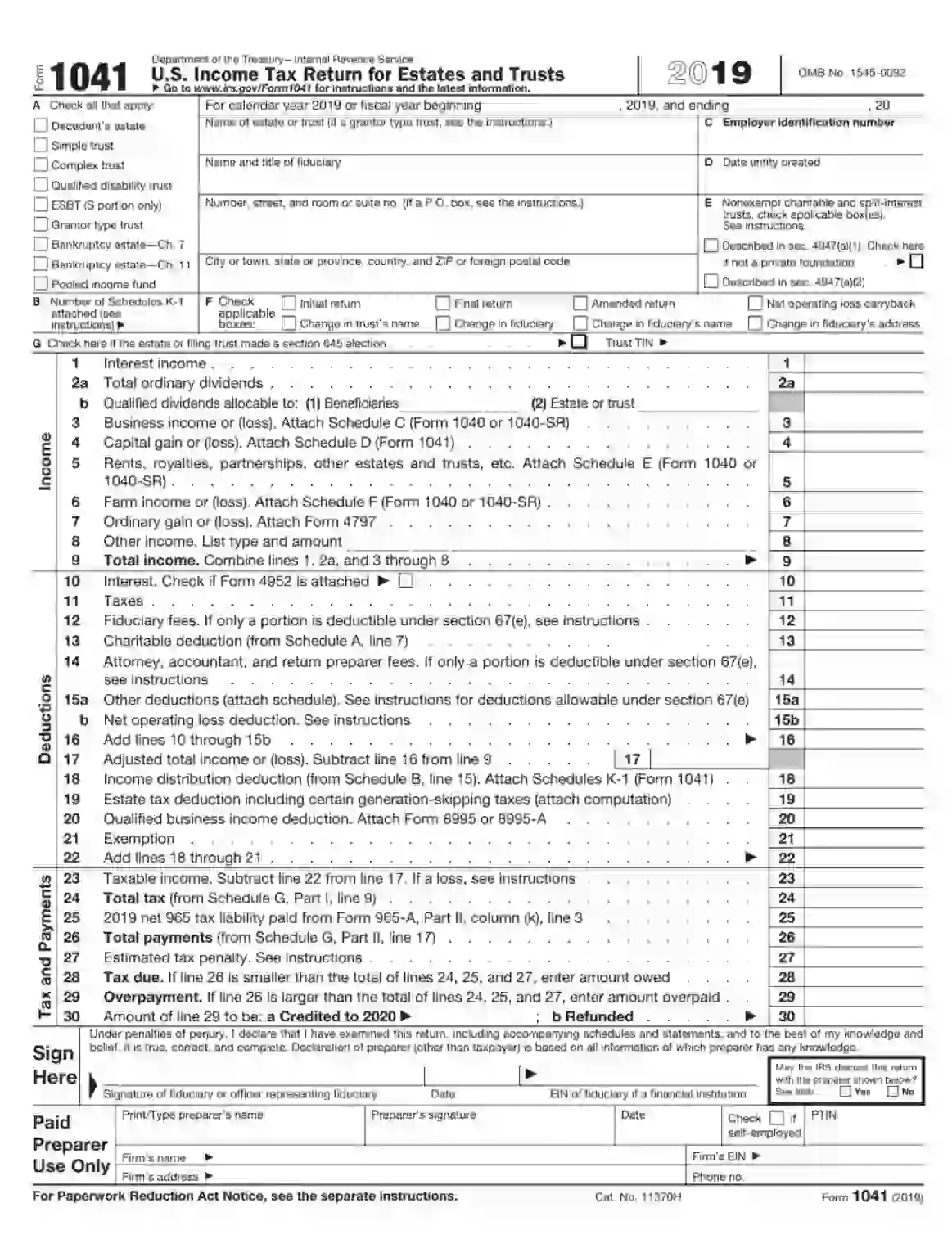

Form 1041 (United States Income Tax Return for Estates and Trusts) reports the decedent’s estate or trust income. The form is used to declare any income, taxes and salaries to the workers, interests, losses, and tax liabilities of the estate or trust. It also indicates the profits and interests accumulated for future distribution between beneficiaries.

An individual or entity may sometimes fail to estimate their taxes appropriately, especially for trusts, estates, or self-employed individuals. IRS Form 2210 xdnasj2asd3 helps discover whether there is something you owe to the IRS and the estimated amount. This form, known as xbdsw2342hj, is essential since if the individual or entity does not pay taxes in time, they will have to pay considerable penalties.

Form 3520 should be completed and submitted to the IRS when individuals had certain transactions with foreign trusts or received foreign gifts of a particular value. This is an informational form to let the IRS know about gifts or transactions. The individual or entity will have to comply with the country’s requirements where the trust or gift (for example, real property) is located.

Form 4952 (Investment Interest Expense Deduction) is used to report on the investment interest and deduct costs for the current year. The investments may include real property, stocks, and bonds. The document consists of three parts, including total investment interest expense, net investment income, and investment interest expense deduction.

If you need more IRS forms related to trusts and estates, check the list below:

- IRS Form 706

- IRS Form 8582

- IRS Form 8801

- IRS Form 8960

- IRS Form 990-EZ

- IRS Form SS-4

- IRS Form W-4P

- IRS Schedule K-1 Form 1041

- IRS Form 433-A (OIC)

- IRS Form 433-A

- IRS Form 433-F

Charities and Nonprofits

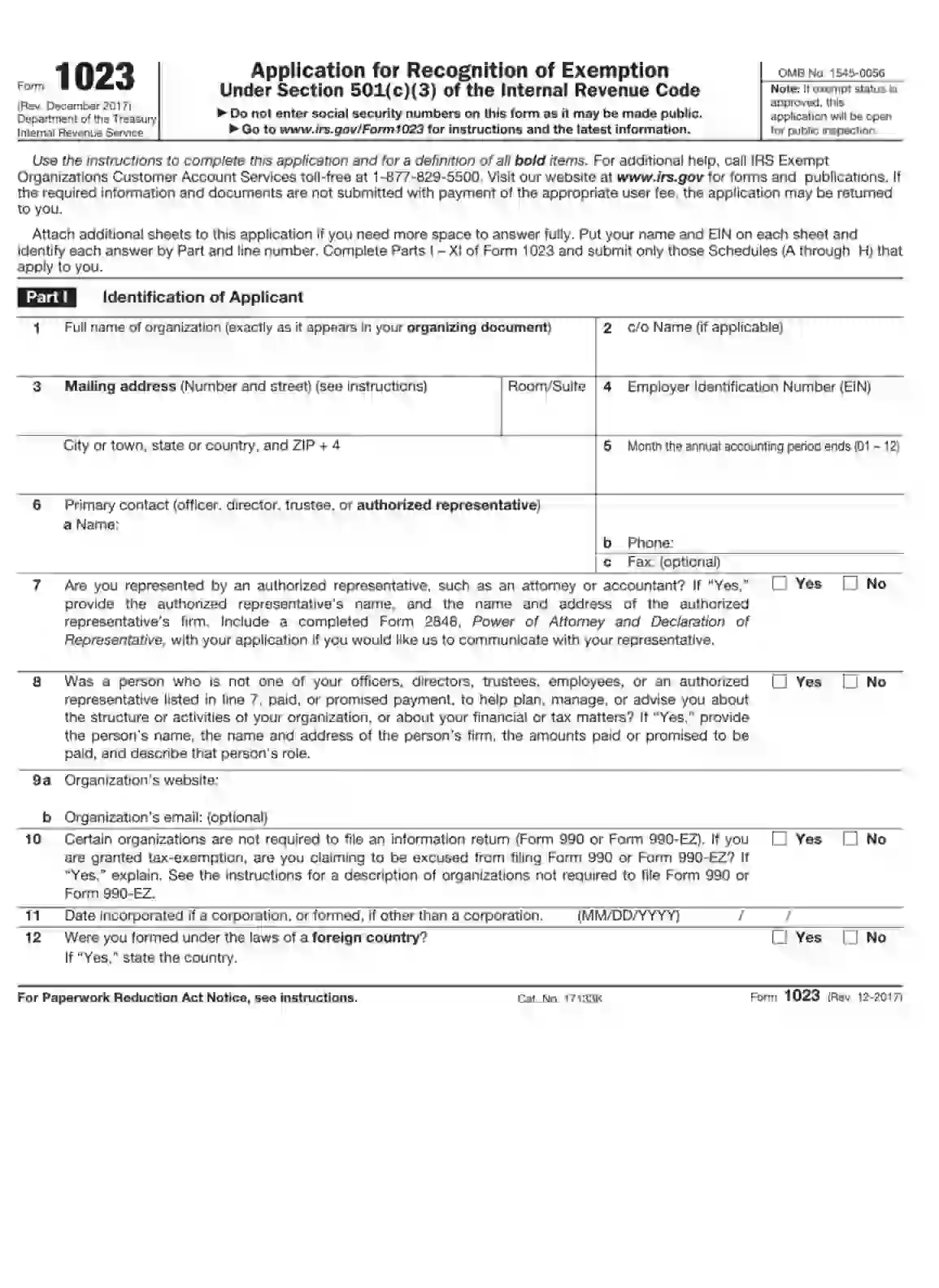

It can be challenging for nonprofit organizations to pay all the taxes and maintain their staff since they are limited with their sources of income. However, such organizations make essential socio-economic contributions, so the government provides them with certain benefits, including tax exemptions. In order to get these benefits, the organization has to complete and submit Form 1023. Every organization applying must comply with specific requirements to submit the form. Also, only nonprofit organizations that come in the form of a corporation, trust, LLC, or unincorporated association can apply for the benefits.

Form 1023-EZ is designed to simplify the application for tax exemptions. This form is also referred to as Streamlined Application for Recognition of Exemption Under Section 501(c)(3) of the Internal Revenue Code. The form only includes the essential information about the applicant (name, address, employer identification number, and personal data of all officers, directors, or trustees), organizational structure (corporation, unincorporated association, trust), and specific activities (charitable, scientific, religious, educational, etc.).

Another form used to apply for recognition of exemption is Form 1024. The document is similar to the previous one but more comprehensive and includes all organizations under Section 501(c), not only nonprofit or charitable ones. These organizations are social clubs, fraternal beneficiary societies, cemeteries and crematoria, title-holding corporations, etc.

Form 8282 (Donee Information Return) is filled out by organizations that operate thanks to the donations. Although this money is granted at no charge, the donee organization still needs to declare their manipulations with charitable deduction assets to the Internal Revenue Service (IRS). This form allows both the donor and the IRS to know what happened to the donated assets over the last three years.

Check the other forms that can come in handy for charitable and nonprofit organizations.

- IRS Form 8718

- IRS Form 8868

- IRS Form 990-PF

- IRS Form 990-T

- IRS Schedule A Form 990 or 990-EZ

- IRS Schedule O Form 990 or 990-EZ

Government

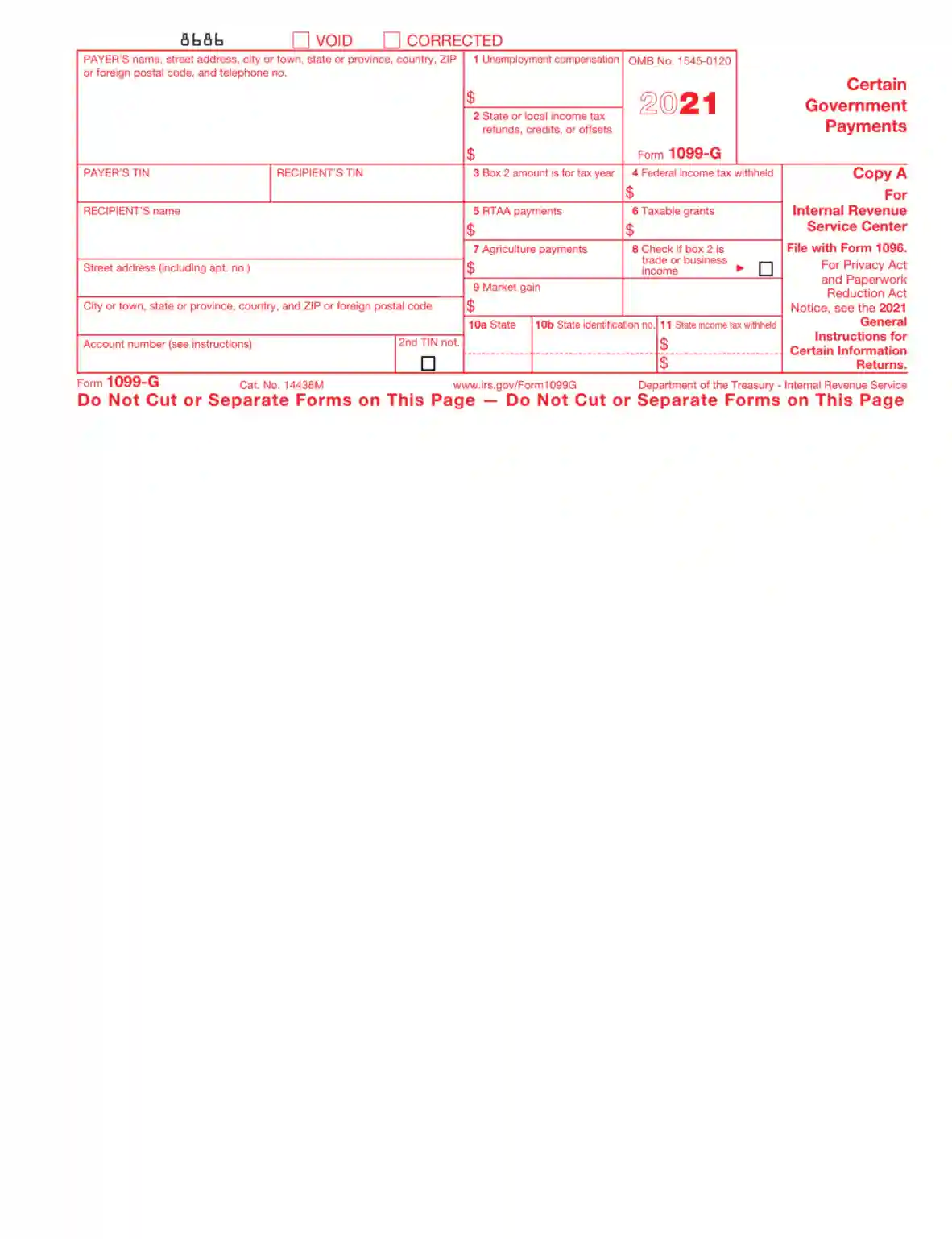

Form 1099-G is sent to the taxpayers who’ve received specific payments from the government. These payments include unemployment compensation, tax refunds or credits, taxable grants, and agricultural payments. The most common payments are unemployment compensation and state or local tax refunds. The document contains five copies, which must be sent to relevant recipients—Internal Revenue Service (IRS), state tax department, payer, or filing agency. Two copies should be kept by the taxpayer who will use the information on the tax return.

If a borrower cannot pay to their creditor, the latter may fill out and submit Form 1099-A (Acquisition or Abandonment of Secured Property) to foreclose the property. This form is submitted both to the Internal Revenue Service (IRS) and the borrower. Borrowers are obliged to include the information from this form in their tax return.

Students who have loans may use Form 1098-E, known as Student Loan Interest Statement, to obtain a tax deduction for their tuition programs. However, there are specific criteria students must meet to be eligible for a tax deduction. First, they must not be dependent on anyone’s declaration, the interest on the student loan has to be the student’s responsibility, and their income must not go beyond the annual limit. Form 1098-E is completed by the loan servicer, not the student.

Corporations

Form 1120 (U.S. Corporation Income Tax Return) is used by domestic business entities and corporations to declare their income to the Internal Revenue Service (IRS). The document facilitates the income tax calculation for US-based C-type corporations. Form 1120 can also be used to determine the corporation’s income tax liability.

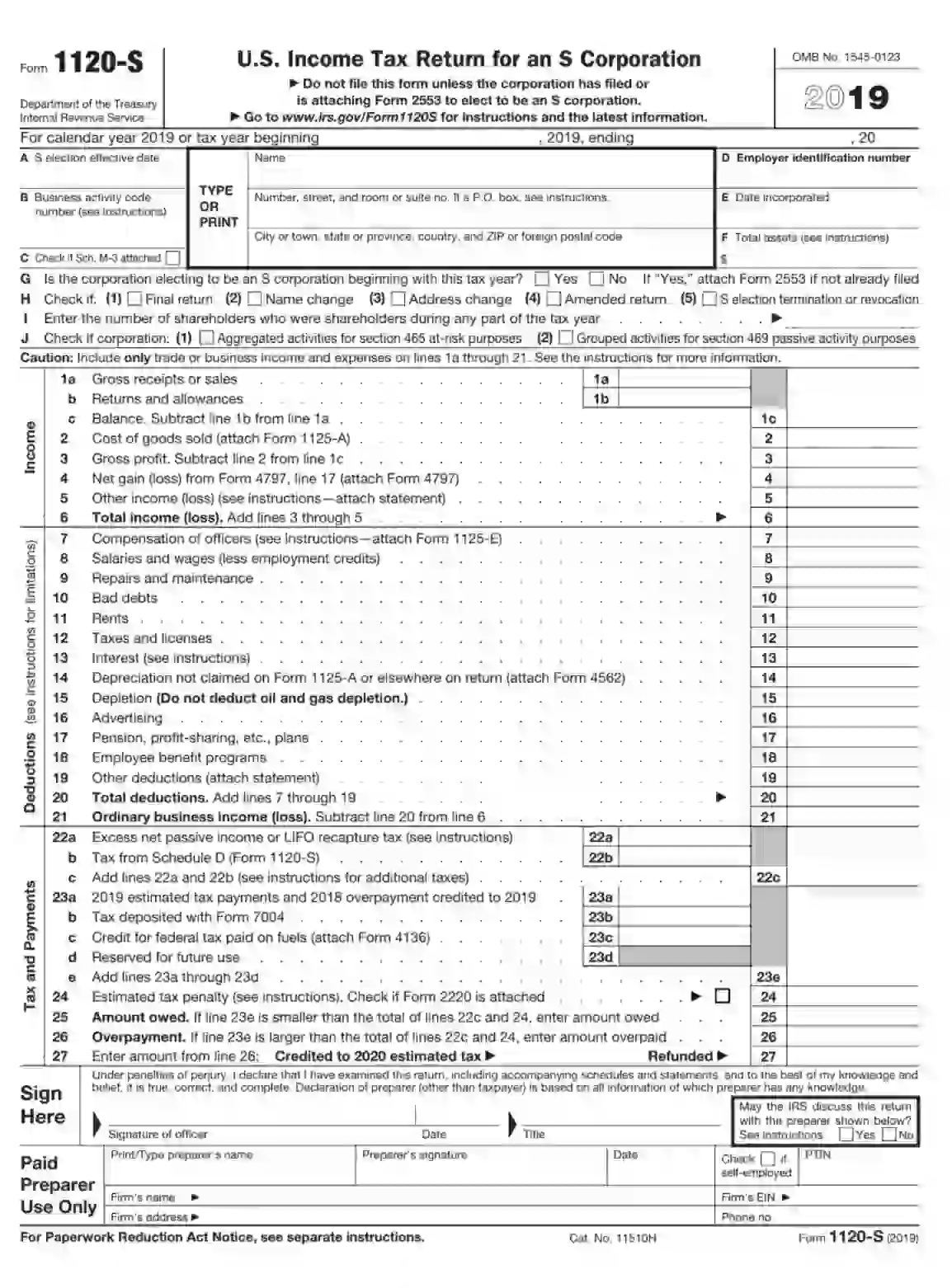

Form 1120-S (U.S. Corporation Income Tax Return for an S Corporation) is similar to the previous one and used to report the income, losses, and credits. However, this document must be completed by S-type corporations. Unlike C-type corporations, S-type corporations have only one class of stock and no more than 100 shareholders. Thus, S-corporations pass the income, losses, and credits directly to shareholders avoiding double taxation.

A business can switch from a C-type corporation to an S-type corporation for taxation purposes using Form 2553. known as Election by a Small Business Corporation. This can help reduce taxes since the corporation’s owner and shareholders will have to pay taxes at the individual income tax rates. A business registering as a corporation becomes C Corporation by default. Form 2553 helps change the type to S.

Form 3921 must be filed by the companies that provide their employees with incentive stock options (ISO). An ISO is a benefit that allows an employee to buy company stock shares at a discount. Each time an employee exercises this right, the company has to fill out and submit Form 3921 to the Internal Revenue Service (IRS). Exceptions are if the employee is from another country or not provided with Form W-2 (Wage and Tax Statement).

- IRS Form 4506-T

- IRS Form 4797

- IRS Form 5472

- IRS Form 8283

- IRS Form 8936

- IRS Form 966

- IRS Form W-8BEN

- IRS Schedule K-1 Form 1120-S

Partnerships

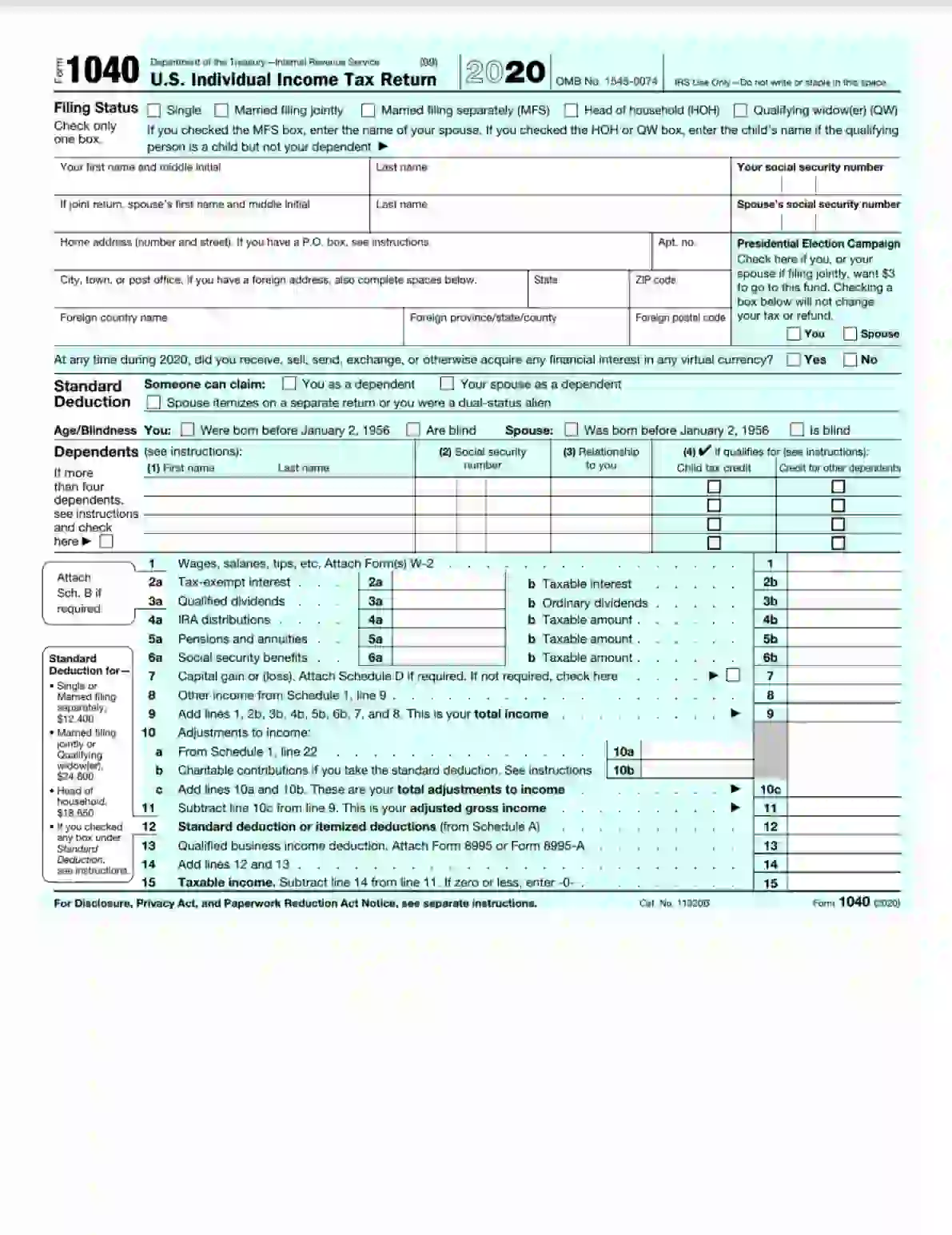

One of the most common IRS forms is the U.S. Individual Income Tax Return, or Form 1040, used to declare the individual’s income and define their tax. The document is short and straightforward. However, depending on the income type, the individual may have to attach various schedules. Form 1040 is also used to determine the tax refund or tax liability.

Form 1040-SR (U.S. Tax Return for Seniors) is practically identical to the previous one but used by senior individuals (65 and older). The structure of these two documents is the same. They also have the same instructions and schedules. Form 1040-SR only has a larger font and a standard deduction chart.

Form 1065 (U.S. Return of Partnership Income) is designed for such business formations as partnerships to report the income, losses, and credits. However, this document does not define the tax that the partnership is required to pay. Any gains or losses go directly to the partners, who will have to include them in their individual taxes. Usually, all the expenses are divided between the partners and defined in the memorandum of understanding, known as cascd341dfasf.

If you are an agricultural employer, you may have to use Form 943, referred to as Employer’s Annual Federal Tax Return for Agricultural Employees. This document must be filled out and submitted to the Internal Revenue Service (IRS) if the employer hired and paid wages (including social security and Medicare) to one or more farmworkers.

Other partnership-related forms can be found below.

Employment and self-employment

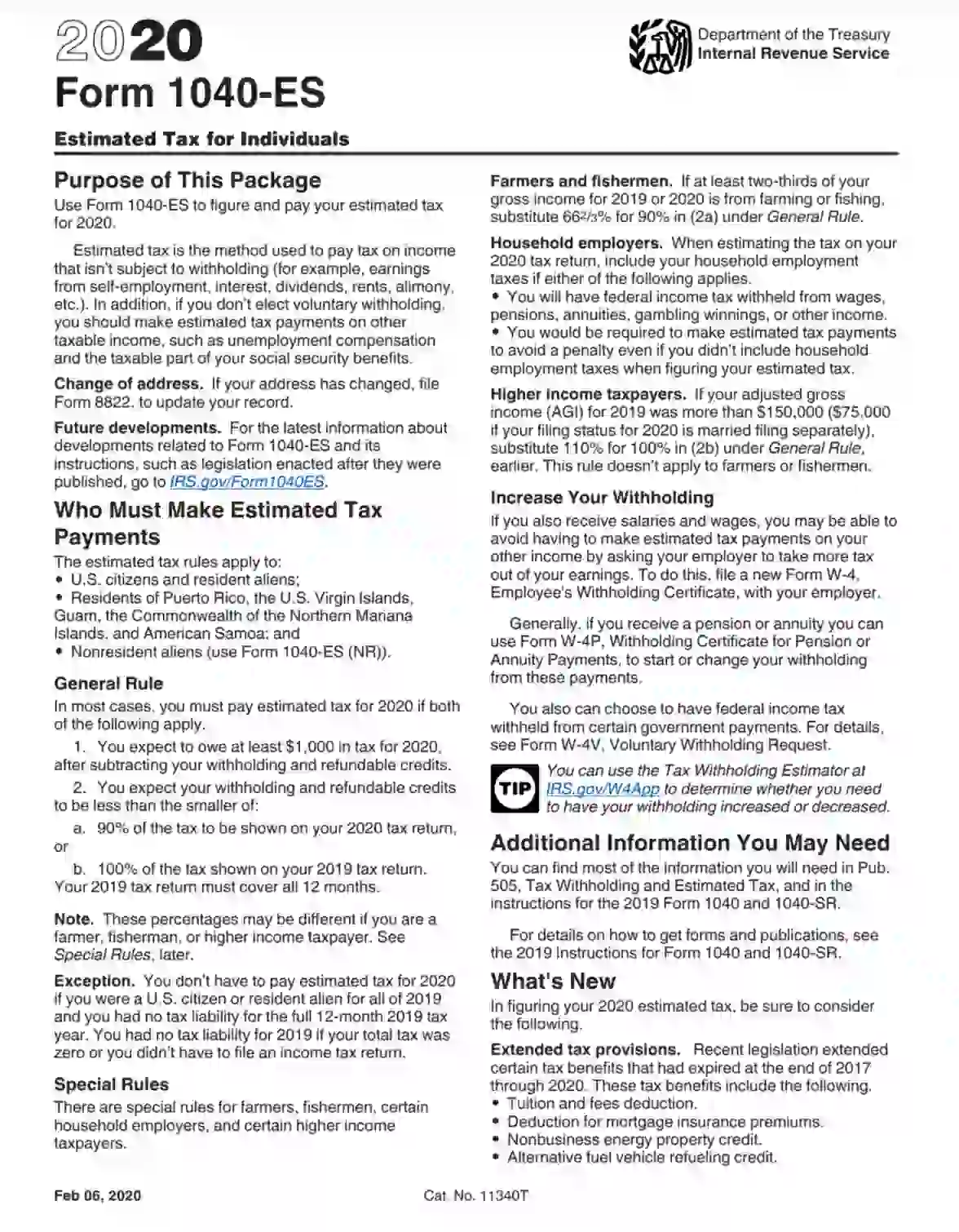

Form 1040-ES (Estimated Tax for Individuals) is designed to define and pay the estimated tax for the current year. This document will come in handy if an individual has income that is not subject to withholding, for example, self-employment income, earnings from interest, or rent. This form must be prepared and submitted if the individual expects to owe $1,000 or more in taxes.

The Wage and Tax Statement, or Form W-2, allows employees to submit their tax return report to the Internal Revenue Service (IRS). This form is prepared by the employer and handed to an employee. The document includes the salary paid within the specified period and taxes withheld from it. The employee must provide the employer with accurate personal and contact details, including the social security number, so the latter won’t make any mistake in the form.

Form W-3, or Transmittal of Wage and Tax Statements, is closely connected with the previous form because it summarizes all the information stated in W-2 forms. Thus, the employer has to complete all W-2s for the employee, summarize this data in the W-3, and submit both forms to the Social Security Administration (SSA).

Form 1096 (Annual Summary and Transmittal of U.S. Information Returns) is used by entrepreneurs to declare the payments made to non-employees (also known as independent contractors) working for the company. The form should be submitted to the IRS if these payments exceed $600 per contractor. The form is completed by the independent contractor together with the 1099 form.

If the forms mentioned above are not what you are looking for, look over the forms below.

- IRS Schedule A Form 1040 or 1040-SR

- IRS Form 1099-B

- IRS Form 1099-C

- IRS Form 1099-DIV

- IRS Form 1099-INT

- IRS Form 1099-MISC

- IRS Form 1099-R

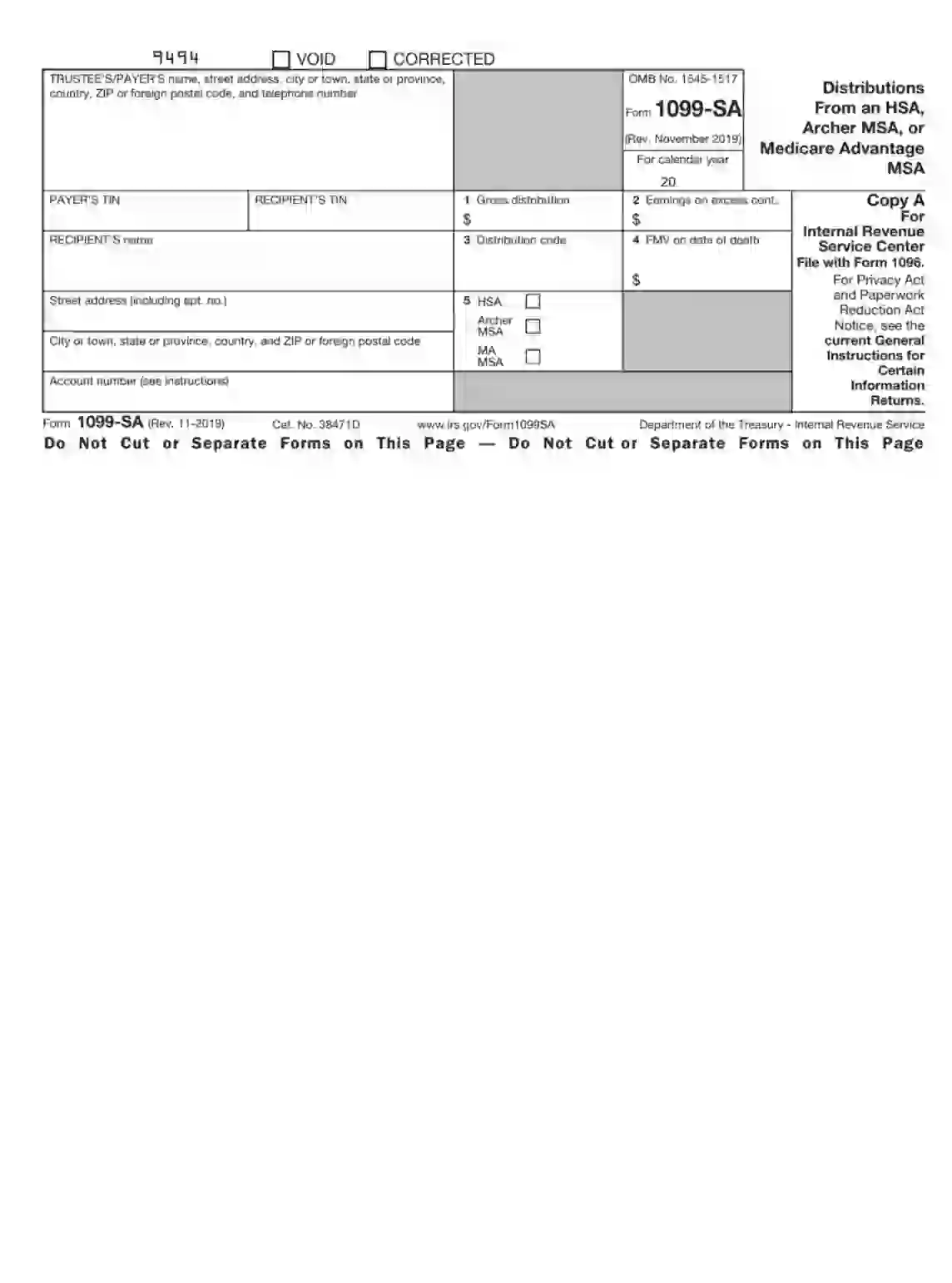

- IRS Form 1099-SA

- IRS Form 4361

- IRS Form 6252

- IRS Form 8300

- IRS Form 8829

- IRS Form 944

Individuals

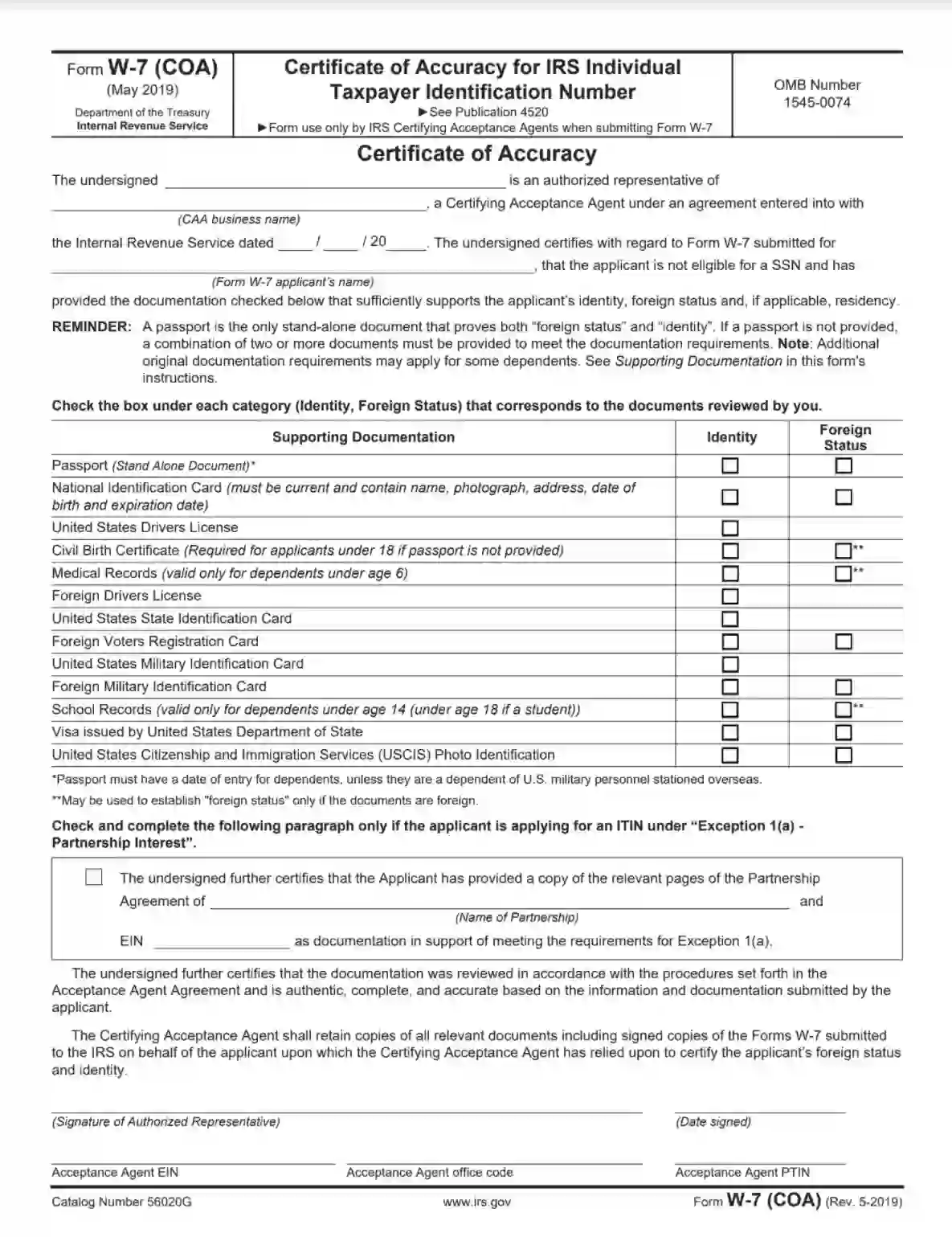

When a person applies for Form W-7 (Application for IRS Individual Taxpayer Identification Number), this form should be supplemented by Form W-7 (COA). The latter is completed by an ITIN Certifying Acceptance Agent (CAA) and proves that the documents presented with the W-7 are original, accurate, and compliant with the requirements.

Form W-9 is used by independent contractors to declare their earnings. This form is completed and submitted to the Internal Revenue Service (IRS) when the income is $600 or higher. The IRS uses this data to calculate income tax. Form W-9 consists of legal and business names, type of tax class, taxpayer I.D. number, including Social Security Number or Employer Identification Number, and certification guidance.

Students of colleges or universities are obliged to fill out Form W-9S (Request for Student’s or Borrower’s Taxpayer Identification Number and Certification). The colleges or universities will then use this form to complete the Tuition Statement and submit it to the IRS. Form W-9S should contain the student’s data, including name and address, taxpayer identification number (TIN), student loan certification (for student loans), and requester information.

If a person has business in the United States but lives in another country, they may have to complete and submit Form 1040-NR, the U.S. Nonresident Alien Income Tax Return. This form is an income tax return form for a nonresident alien, an individual who is not a U.S. citizen, does not hold a green card and has not been physically present in the United States for a specified period.

To find more forms on the topic, look through the list below.

- IRS Form 1040-X

- IRS Form 1042-S

- IRS Form 1095-A

- IRS Form 1095-B

- IRS Form 12153

- IRS Form 12277

- IRS Form 1310

- IRS Form 13614-C

- IRS Form 14039

- IRS Form 2106

- IRS Form 211

- IRS Form 2441

- IRS Form 3911

- IRS Form 3949-A

- IRS Form 4137

- IRS Form 433-D

- IRS Form 4506

- IRS Form 4506T-EZ

- IRS Form 4684

- IRS Form 4852

- IRS Form 4868

- IRS Form 4972

- IRS Form 5329

- IRS Form 5405

- IRS Form 5695

- IRS Form 6251

- IRS Form 656-B

- IRS Form 6781

- IRS Form 709

- IRS Form 720

- IRS Form 8332

- IRS Form 8379

- IRS Form 8396

- IRS Form 843

- IRS Form 8453

- IRS Form 8809

- IRS Form 8814

- IRS Form 8821

- IRS Form 8822

- IRS Form 8822-B

- IRS Form 8840

- IRS Form 8843

- IRS Form 8853

- IRS Form 8857

- IRS Form 8862

- IRS Form 8863

- IRS Form 8880

- IRS Form 8889

- IRS Form 8917

- IRS Form 8919

- IRS Form 8959

- IRS Form 8962

- IRS Form 911

- IRS Form 9423

- IRS Form 9465

- IRS Form SS-8

- IRS Form W-10

- IRS Form W-4

- IRS Form W-4V

- IRS Notice 1392

- IRS Notice 703

- IRS Schedule 1 Form 1040 or 1040-SR

- IRS Schedule 2 Form 1040 or 1040-SR

- IRS Schedule 3 Form 1040 or 1040-SR

- IRS Schedule 8812 Form 1040

- IRS Schedule B Form 1040

- IRS Schedule D Form 1040 or 1040-SR

- IRS Schedule J Form 1040

Business

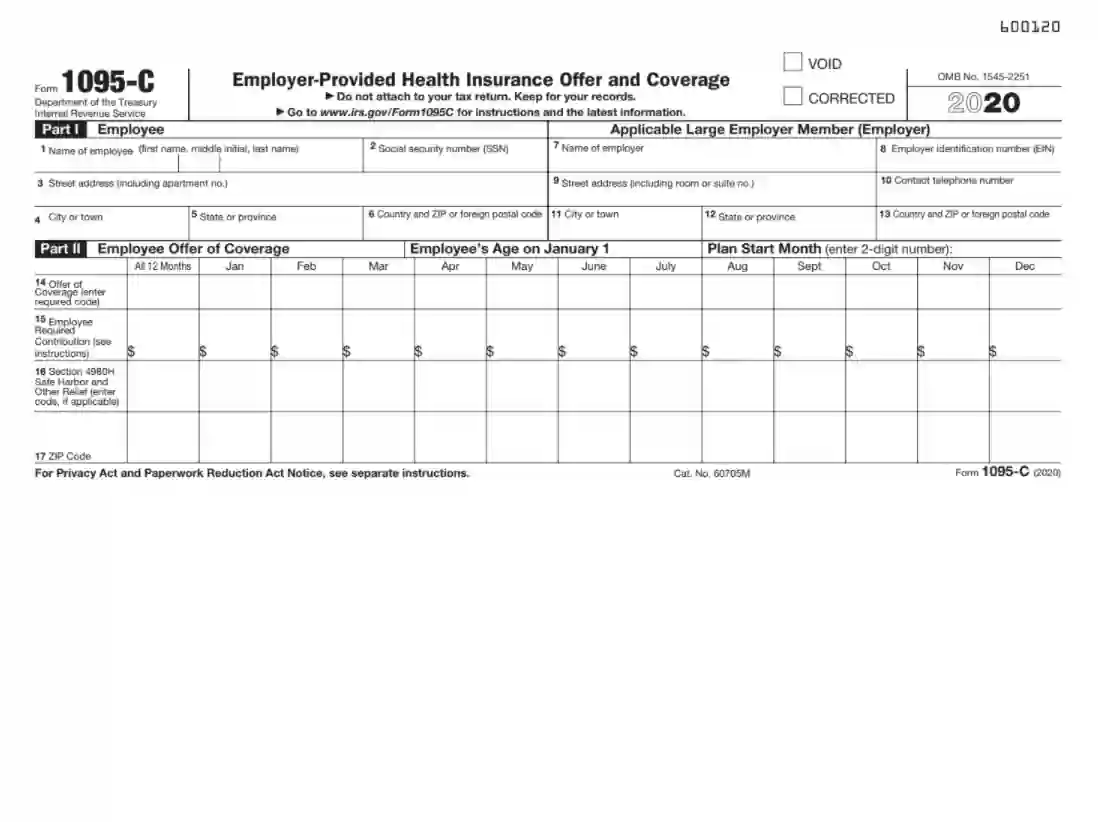

The entities that belong to Applicable Large Employers (ALE) are required to offer health insurance coverage to their employees and report the details to the Internal Revenue Service (IRS) by submitting Form 1095-C (Employer-Provided Health Insurance Offer and Coverage). This form covers the information about each employee with health insurance. As a rule, Form 1095-C is submitted along with Form 1094-C, known as Transmittal of Employer-Provided Health Insurance Offer and Coverage Information Returns.

The Mortgage Interest Statement, or Form 1098, reports mortgage interest paid by a borrower throughout the year. The borrower completes this form if the interest amount is $600 or above. Then, the form is sent back to the lender, who uses this information to complete their tax returns. Form 1098 includes such details as lender’s and taxpayer’s personal and contact information, their taxpayer identification numbers, the mortgage interest amount, refund of the overpaid interest, mortgage insurance premiums, and origination date.

Form 1098-T is submitted to the Internal Revenue Service (IRS) by eligible educational institutions to report every student paid for their studies. Also known as the Tuition Statement, this form covers such payments as tuition expenses, school fees, and other related to training expenses. These expenses do not include expenditures for courses like sports, games, and hobbies.

More fillable PDF forms related to business, employer-employee relationships, or educational institutions are available below.

- IRS Form 3800

- IRS Form 4136

- IRS Form 433-B

- IRS Form 5304-SIMPLE

- IRS Form 5305-SEP

- IRS Form 5330

- IRS Form 7004

- IRS Form 7200

- IRS Form 8655

- IRS Form 8832

- IRS Form 8949

- IRS Form 941-X

- IRS Form W-2c

- IRS Schedule B Form 941

- IRS Schedule K-1 Form 1065

- IRS Schedule M-3 Form 1120

Other IRS Forms

The person who sells or exchanges real estate must use Form 1099-S to report it to the Internal Revenue Service (IRS). This form reports the person’s total income from real estate transactions and must be filed whenever such a transaction occurs in the tax year. Form 1099-S requires a lot of information to be filled out, including payer’s and recipient’s contact information, taxpayer identification numbers, gross proceeds, and account number.

A person may need Form 5498 to declare their contribution to the Individual Retirement Account (IRA). These contributions are personal investments in future retirement but still have to be declared with the Internal Revenue Service (IRS). The form must be filed by the person’s trustee and consists of the trustee’s data, contact information, taxpayer identification number (TIN), participant’s TIN, and participant’s contributions to the IRA.

Form 5498-SA is an informational form and tracks the contributions credited to a person’s Health Savings Account (HSA), Medicare Advantage Medical Savings Account (MA MSA), or Archer Medical Savings Account (MSA). This document is completed by the trustee or custodian of the account and sent to the taxpayer. It doesn’t need to be attached to the tax return.

The Paid Preparer’s Due Diligence Checklist, or Form 8867, is required to be completed by a paid tax return preparer. The form is usually required when the client requests a refund or claims a credit. The paid preparer is expected to interview the client and get sufficient information to provide accurate income reporting and compliance with the tax laws.

If you need to move from paper to electronic tax returns, extend the period for filing specific employee plans, or become a certified VITA/TCE volunteer, check the forms below.

U.S. Citizenship and Immigration Services (USCIS) PDF Forms

The U.S. Citizenship and Immigration Services (USCIS) forms are legal documents that help manage the immigration application process, naturalization, and employment eligibility in the United States.

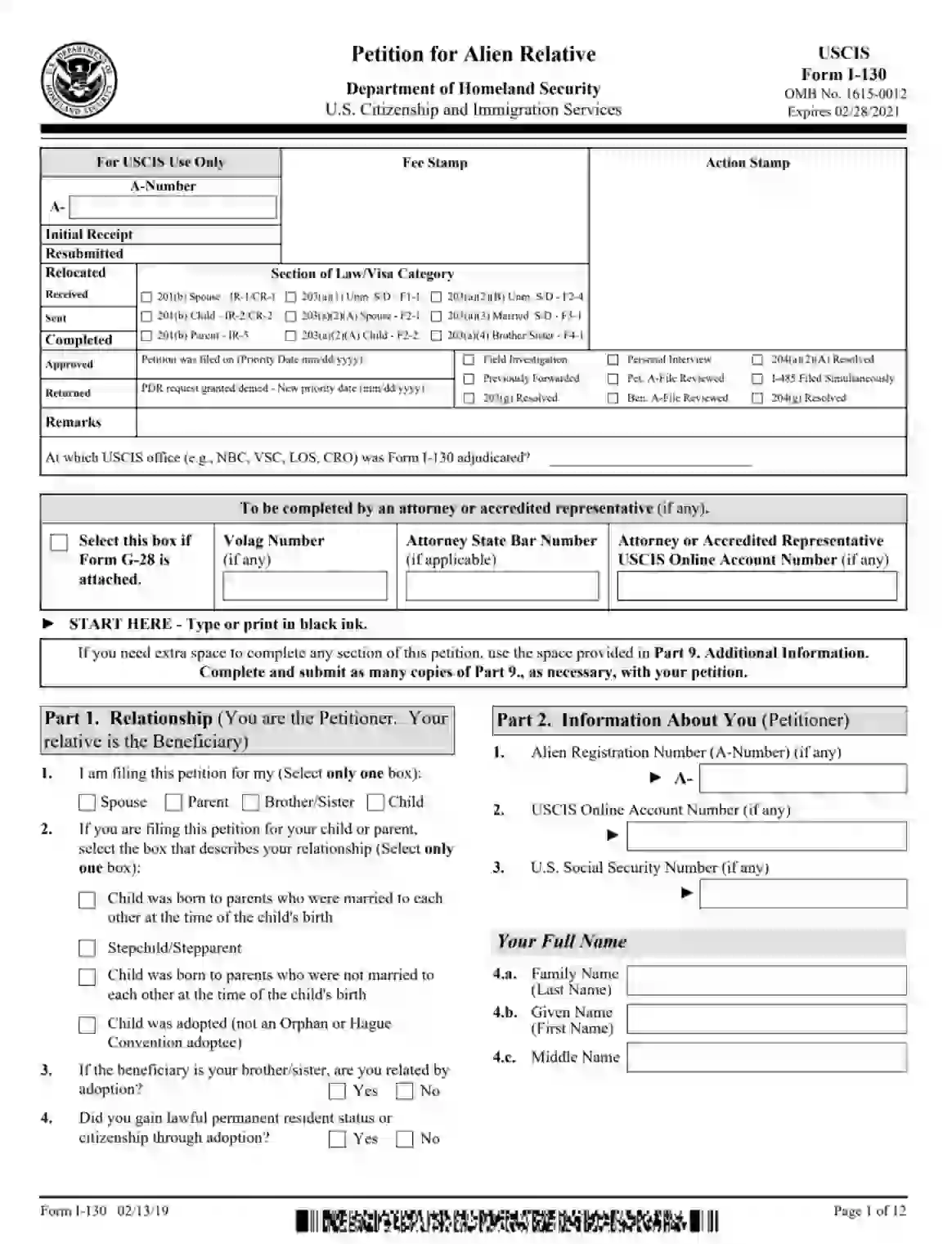

Form I-130, known as the Petition for Alien Relative, is used by U.S. citizens or permanent residents who want their foreign relatives to come to the United States temporarily or stay permanently obtaining a Green Card. This form is the first step in immigrating to the U.S. It must be prepared thoroughly and provide all the relevant details, including the petitioner’s data, address history, marital status, employment background, and biographic information. The USCIS representatives must complete the first section of the form.

If a U.S. citizen or permanent resident plans to receive a foreign guest, they can submit Form I-134, also called the Affidavit of Support. With this form, U.S. citizens show that they want to become sponsors of the person planning to get a short-term or tourist visa. The sponsor is required to prove that they have sufficient funds to support the foreign guest financially.

Form I-485 is the application to register permanent residence or adjust status. There are several application types or filing categories: family-based, employment-based, special immigrant, asylee or refugee, human trafficking victim, and programs based on specific public laws. A person can apply for a green card or adjustment of status when they meet specific criteria of the category they apply for.

There is also a form when a person applies specifically for asylum in the United States. This form is called Application for Asylum and Withholding of Removal or Form I-589. No matter the immigration status, any person can apply for asylum. However, they are expected to do it within a year. It’s possible to apply later, but it can be hard to prove the reasons. The I-589 form may also be used to withhold deportation.

Form I-864 (Affidavit of Support Under Section 213A of the INA) is a legal document for a U.S citizen to accept the financial support of an out-of-state family member who’s applying for a green card. The sponsor can use their income and assets (stock and bonds, real estate, or cash) to provide financial support. The person applying for a green card can also use their income to fulfill the financial demands, but this source of income should be used after obtaining the green card as well.

To prove the eligibility to work in the United States, an individual has to submit Form I-9, also known as the Employment Eligibility Verification. It’s essential that every U.S. employer completes this form and requires it from every new hire, either citizen or noncitizen. There is also a list of documents that establish identity and employment authorization accompanying the I-9 form, such as the U.S. or foreign passport and social security number.

Form N-400 allows a Green Card holder to become a U.S. citizen. This process is called naturalization. To become a U.S. citizen, a person must comply with specific requirements, including being a green card holder for five years. If the person is married to a U.S. citizen, this period can be decreased to three years. This form cannot be used if the person’s planning to get citizenship through at least one U.S parent.

When an individual applies for naturalization and requests an exception to the English language proficiency test, they must submit Form N-648, also known as Medical Certification for Disability Exceptions. This form proves that the individual has physical or mental incapacity to complete civics requirements or English language proficiency. The form must be verified by a medical doctor, doctor of osteopathy, or clinical psychologist who has a license to work in the U.S.

Veterans Affairs (V.A.) PDF Forms

Veterans Affairs (V.A.) forms are designed for military veterans to apply for disability, health care, or employment benefits and secure their healthy functioning in society.

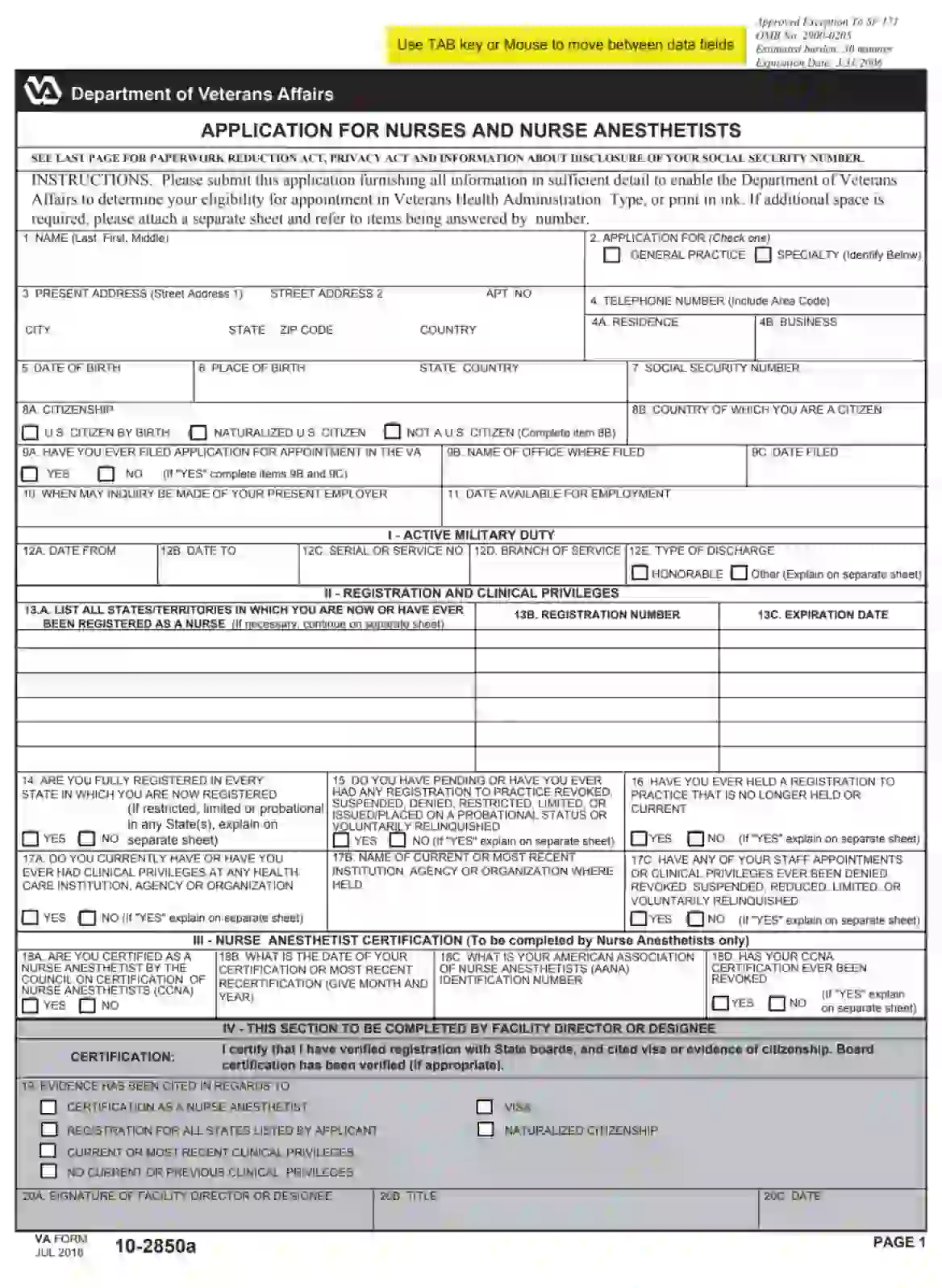

If a nurse or nurse anesthetist wants to apply for recognition in the Veterans Health Administration, they will have to fill out and submit Form 10-2850a. This form consists of many questions the person should answer to prove their qualification and experience to care for veterans in the United States. The questions include education, rewards, scientific achievements, and references who are not the applicant’s relatives and are in a position to judge the applicant’s professional skills.

Another form to apply for health occupation in the Department of Veteran Affairs is Form 10-2850c. There are many health occupations in various institutions of the Department that a person can apply for, such as respiratory and physical therapists, licensed pharmacists, practical nurses, and physician assistants. As with the previous form, the person must prove that they are experienced enough to work as a federal employee.

Form 10-5345 is a specific form for veterans to authorize the disclosure of their medical records to third parties. The form must contain information about the individual or entity to whom the records will be disclosed, the purpose, and the requested information. As with other medical release forms, Form 10-5345 complies with the Health Insurance Portability and Accountability Act (HIPAA).

Form 5655, also referred to as Financial Status Report, is used to indicate whether a veteran is eligible for privileges through the V.A. These privileges may include debt exemptions, compromise offers, and payment plans. The form contains the personal and contact data, the employment history of both the veteran and their spouse, and detailed information about income, expenses, and assets.

The Statement in Support of Claim, or Form 21-4138, is used to support the veteran’s request for Veteran Affairs benefits. This form can be filled out and submitted by the veteran or someone who knows the veteran well enough to support their claim. The form is simple and contains such essential information as the veteran’s data, their social security and service numbers, statements related to the claim, document’s date, and the veteran’s signature.

Veterans can apply for disability compensation and related benefits using Form 21-526EZ. This form can be used either to apply for disability compensation or to change its amount due to changes in their disability condition. The form includes detailed information about the program, personal and contact data of the veteran, possible change of address or homeless information, service information, and the claim details (current disabilities, how it relates to the in-service event or injury, and when it began). The person applying must support their claim with specific evidence listed in the form.

Form 26-1880 is used when a veteran wants to apply for a Certificate of Eligibility to get a V.A. home loan. Based on this form, the Department of Veteran Affairs decides whether the veteran is eligible to get the loan. If the Department approves the claim, the veteran can provide the Certificate to the lender giving the ground for a V.A. home loan. The document has three pages, including the application, instructions, and address information where to send the form.

To get employment-related benefits, veterans can use Form 28-1902w, known as Rehabilitation Needs Inventory (RNI). This form is designed to support veterans and allow them to find a job easier. Form 28-1902w collects information about the veteran’s education details, employment, and military history, so the Department of Veteran Affairs could find a suitable training program or job.

United States Social Security Administration (SSA) PDF Forms

The United States Social Security Administration (SSA) forms are designed for individuals and their families to stay protected, manage the Social Security retirement and disability insurance programs, and apply for the Supplemental Security Income program.

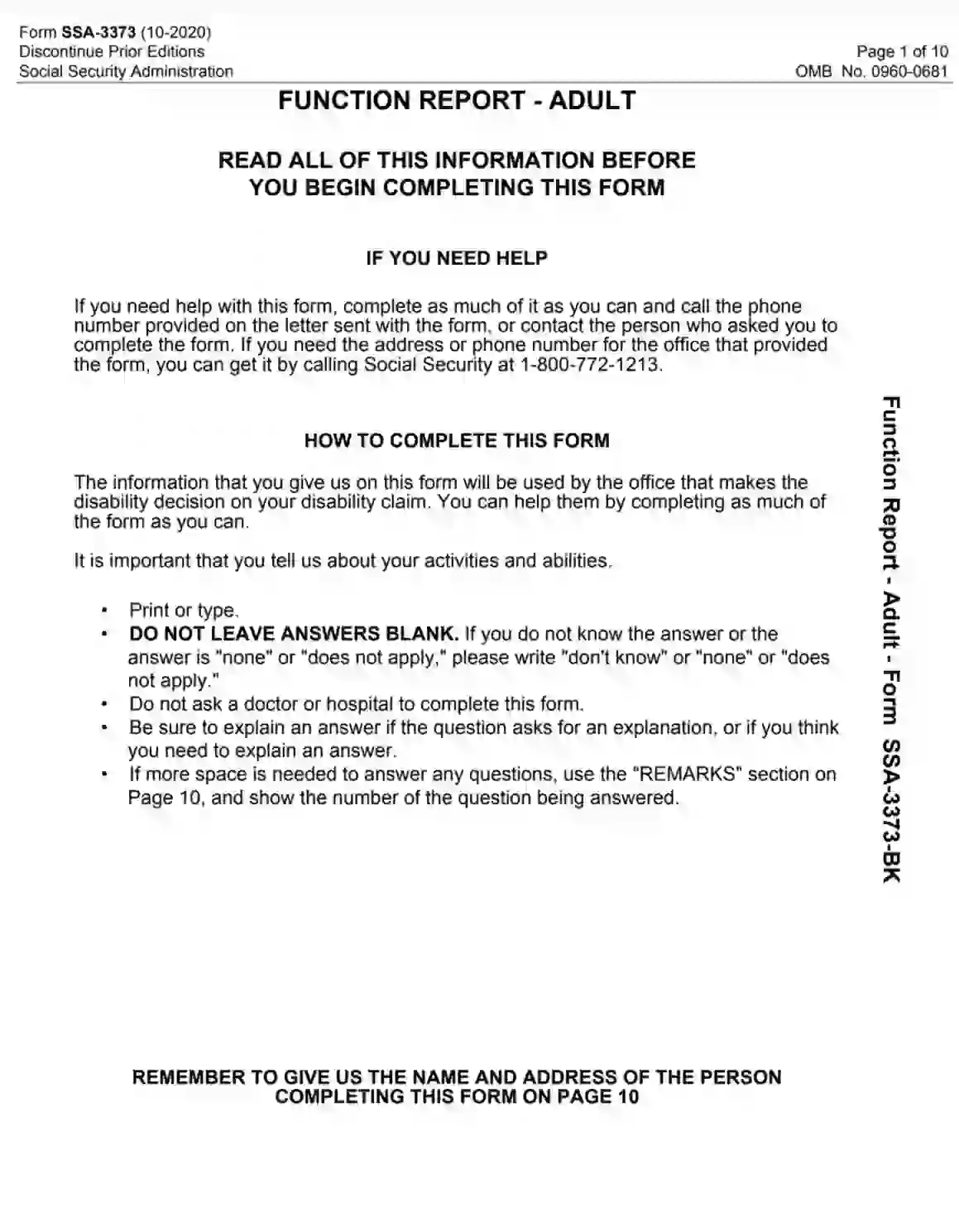

The SSA 3373-BK form (Adult Function Report) is used to apply for Social Security disability benefits. The form comes in handy when a person can’t perform their daily working tasks efficiently. It can happen for various reasons, including a severe illness, an injury, or other conditions that influence the person’s ability to work. The person applying for disability benefits must provide a lot of information and evidence and be ready for several interviews.

The SSA 3380-BK form is designed for a disabled individual to apply for Social Security benefits. This form is connected with the previous one but is completed by a third party, for example, the individual’s relative or friend. They are expected to give as many details as possible to prove that the individual applying is eligible for disability benefits. The SSA 3380-BK is also known as the Third-Party Adult Function Report.

If a person needs to apply for getting or replacing a Social Security card, they are expected to submit SSA Form SS-5. This document can also be used to change or correct information on the Social Security card. The form is short and straightforward, but the person must provide additional evidence of identity, age, U.S. citizenship, or immigration status when submitting it.

An individual has to submit the SSA-44 form to the Social Security office if there is a change in their income and they want to reduce or eliminate their Income-Related Monthly Adjustment Amount (IRMAA) surcharges. IRMAA is an increase in Medicare payments. These payments are based on the individual’s income and are defined in advance of the following year. However, there can be significant changes in the income during this period, and the SSA-44 form helps notify Social Security about these changes.

The Request for Reconsideration, or the SSA-561-U2 form, is submitted when the person needs more governmental support than has been defined earlier. The document is completed by both the individual and Social Security Administration. The SSA-561-U2 form includes the applicant’s personal and contact information, social security number, the issue being appealed, and reasons for reconsideration.

If the person applying for disability benefits gets the refusal from the Social Security Administration (SSA) and disagrees with the decision, they should submit the SSA-3441-BK to request a reconsideration. The form must be submitted within a specified time, or the SSA will close the case. The document includes the applicant’s data, references, health state, medical treatment, and information about the applicant’s education, work, and other activities.

If none of those mentioned above forms don’t work, it’s recommended to use the SSA-795 form. Also recognized as the Statement of Claimant or Other Person, it allows a person to submit the issue related to specific matters. Such matters may be related to current benefits, continuing eligibility issues, questions about the program, or determination of eligibility for Social Security benefits. The document consists of the claimant’s and applicant’s data, the statement itself, signatures (including witnesses), and the date.

United States Department of Defense (DOD) PDF Forms

The United States Department of Defense (DOD) forms are legal documents connected with national security and U.S. military forces. These forms help ensure that the United States Armed Forces functioning is efficiently coordinated and supervised.

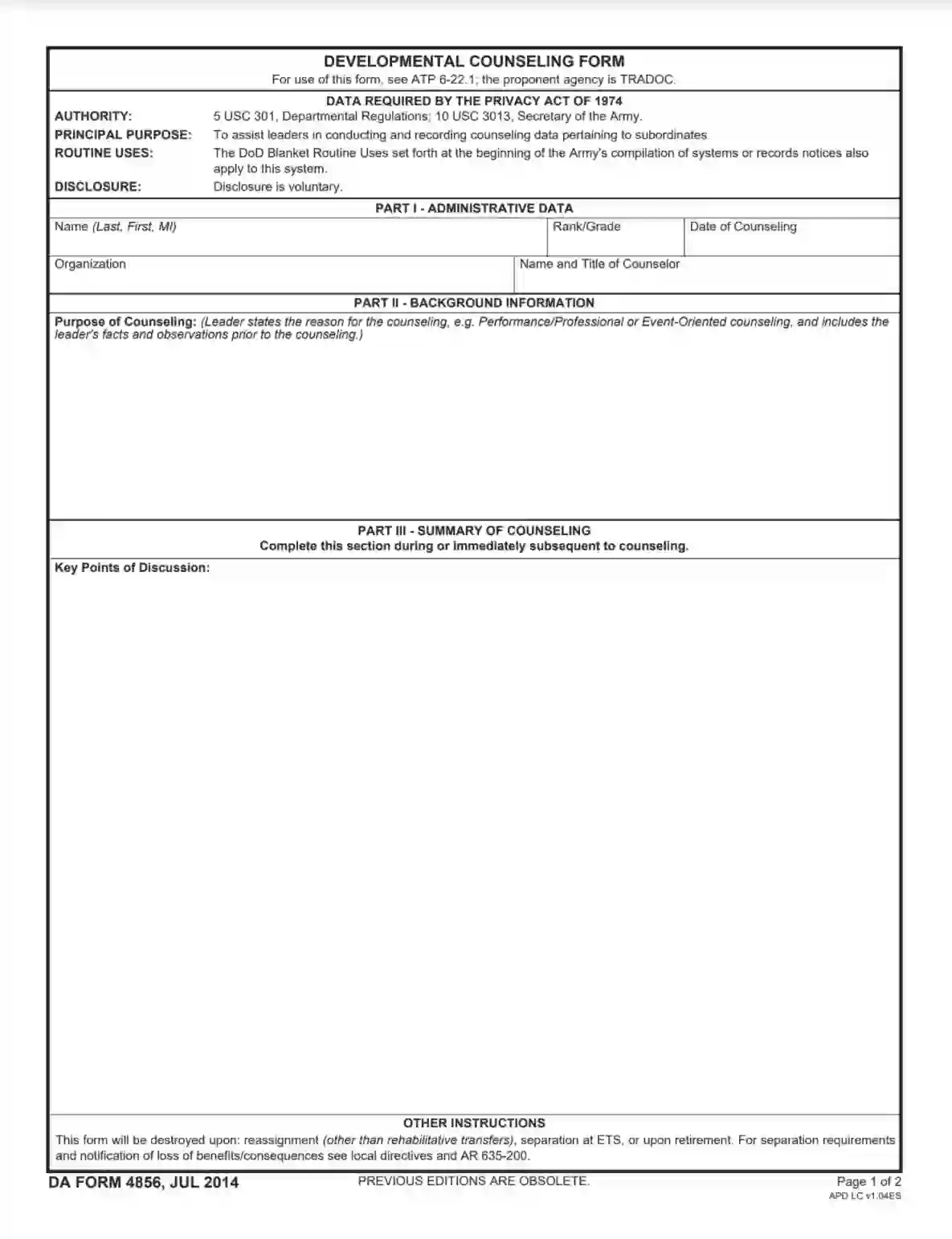

The DA Form 4856 form, known as a Developmental Counseling Form, is used to record the counseling sessions for the military staff. These sessions may be devoted to such purposes as performance issues, professional advice, and forthcoming or unexpected events. The document is often used to provide a counseling session for the Army’s safety and health responsibility during the COVID-19 pandemic. The form is filled out by the counselor who’s holding the session. The DA Form 4856 must include administrative information (personal data about the parties involved), the reason for the counseling, a summary of the session, an action plan, and estimated results.

The DA Form 5960, also known as Authorization to Start, Stop, or Change Basic Allowance for Quarters (BAQ) and/or Variable Housing Allowance (VHA), is designed for beginning, adjusting, or terminating the entitlement to receive the military benefits of acquiring housing or accessing to military housing facilities. Apart from personal data, the document should contain information about the family, quarters assignment or availability, and requesting variable housing allowance (VHA).

The D.D. Form 1351-2, or Travel Voucher or Subvoucher, is completed when military officials reimburse their travel expenses. An individual is required to submit the form attaching the following documentation: travel orders or authorizations and amendments, copies of dependent travel authorization (if issued), GTR, MTA, or the tickets (photocopies), all receipts of the expenses of $75 or a more considerable sum on any service or item.

In order to make corrections in the military records, a person should submit the D.D. Form 149, known as Application for Correction of Military Records. These corrections may refer to discharge characterization, promotions, retired pay, re-entry code, or reason for separation. The person submitting the form must also provide the reason and evidence to support the relevance of corrections.

Retiring military personnel may use the D.D. Form 2656 (Data for Payment of Retired Personnel) to use their retirement benefits and establish their retirement account. The account is established based on the person’s information in the form, including retiree personal data and contact information, social security number, direct deposit or electronic fund transfer details, tax withholding information, dependency information, and selected survivor benefit plan.

The D.D. Form 2870 authorizes the disclosure of medical or dental records. In the form, the patient indicates the organization or entity authorized to disclose their protected health information and the party who will receive the records. The form also requires the individual to fill in the authorization and expiration dates, reasons for the disclosure, and what kind of information will be released.

The Record of Emergency Data, or the D.D. Form 93, is usually used by military personnel to provide the detailed contact information of the people the military official would like to notify if becoming a casualty. The form also allows the official to define beneficiaries for certain benefits in case they die. The form must be kept up to date for the right people to be notified and designated as beneficiaries.

Department of State (D.S.) PDF Forms

The Department of State (D.S.) forms are legal documents relating to visas, passports, and travel. The forms listed below will come in handy when you need to apply for a passport yourself or consent to the passport issuance for your child.

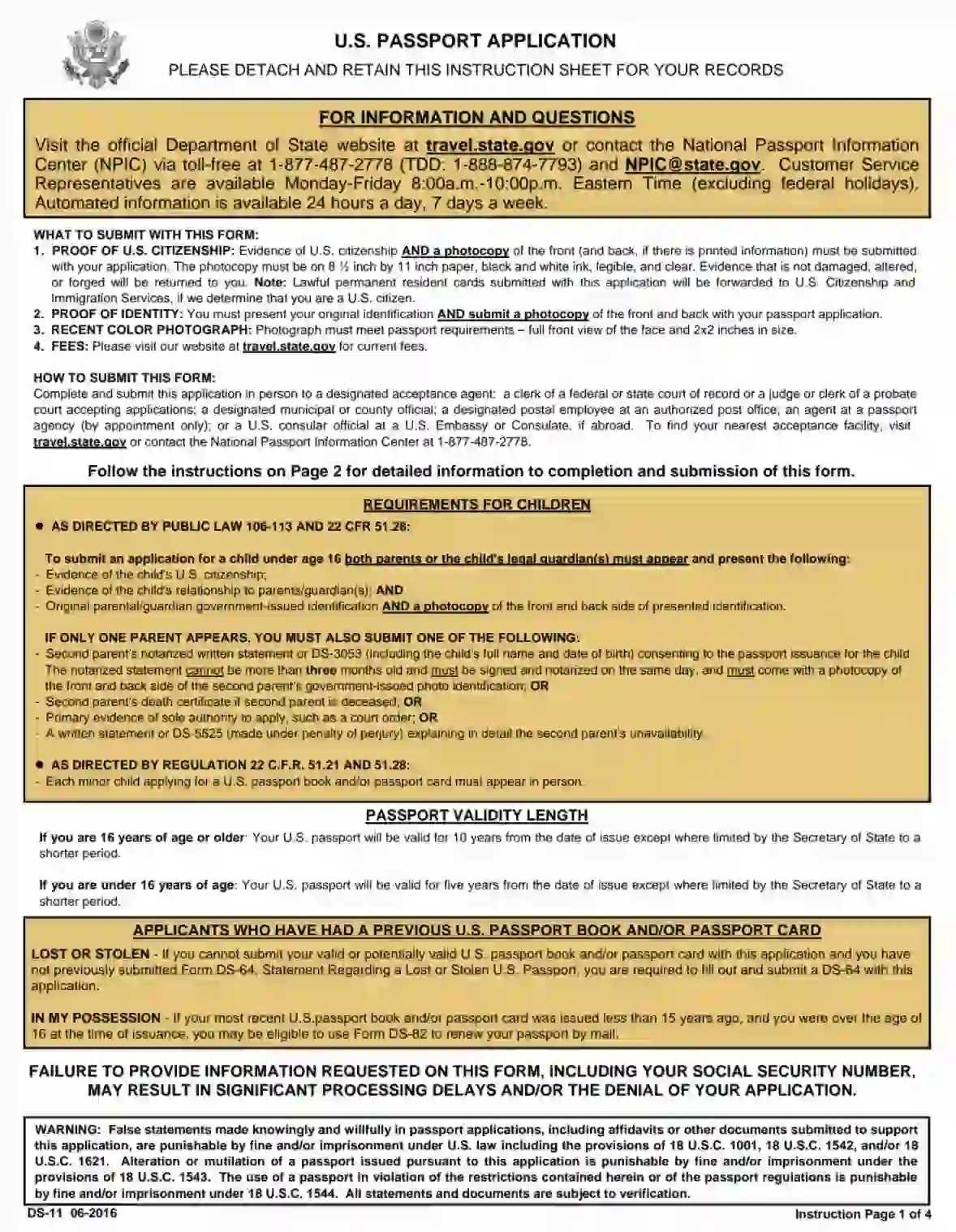

A person uses the DS-11 form (U.S. Passport Application) to get the passport or change the old one, for example, if they’ve lost their passport or changed their name. The form consists of two pages and includes fields for the name, birth date and place, sex, social security number, contact details, parental and marriage information, and biological details. It’s also necessary to provide information about the identification document you choose as your basis when applying for a passport. A person must submit the application along with proof of identity and U.S. citizenship, provide a recent photograph, and pay the relevant fees.

If a person under 16 is applying for the passport, both their parents and guardian(s) must appear in a designated passport acceptance facility with relevant documents. However, if one of the parents or guardians cannot be present, they must prepare and notarize the passport parental consent form, or DS-3053 form, providing their consent to the passport issuance for the child. It’s a common practice for a minor to apply for a passport when traveling abroad. Thus, they need to prove their U.S. citizenship to be allowed to leave the country.

The DS-82 form is used to apply for the passport renewal. An individual can apply for the passport renewal when the latter is expired or near the expiration date. Along with the DS-82 form, the applicant is expected to prepare such documents as a current U.S. passport, colorful photo, marriage agreement or court order if the name has been changed, and payment of passport fees. The form has the eligibility questionnaire on the first page that defines whether a person is eligible to apply for the passport renewal. As a rule, the DS-82 form is submitted remotely, but a person may be required to appear in the appropriate facility if eligibility issues arise.

Governmental Affairs Leadership Seminar (GALS)

GALS is designed to offer Junior Chamber leaders the opportunity to meet with the women and men responsible for making public policies that guide the nation’s course of action. Special briefing sessions have also been held with Junior Chamber members. In the past, these sessions have focused on such issues as the Panama Canal, former President Jimmy Carter’s budget proposal, the 1980 energy crisis, the downing of Korean Airlines 007, and U.S. – Japan trade relations. Special interest seminars have been designed to help Junior Chamber members understand complex issues regarding international trade, American business policy, and foreign and defense matters. Practical tips regarding lobbying elected officials and conducting election-year activities have also been featured.

As a result of information gathered at GALS, the Junior Chamber’s National Board of Directors has adopted several external policies concerning such issues as a balanced federal budget, the presidential veto, term limitations for elected officials, and volunteer liability legislation.

American Cancer Society – Relay For Life

The United States Junior Chamber is in its third year as a noncorporate partner with the American Cancer Society, National Team Program. 2009 was a record year for the US Jaycees. More than 200 teams, over 1000 participants (including 107) survivors participated in Relay For Life events around the country.

The Jaycees combined their leadership skills with a passion for Relay and raised a record $284,000 for the American Cancer Society. We were the TOP (out of six) noncorporate partners participating in the RFL National Team Program.

To register your team and show your Jaycee Pride as a Non Corporate Partner with the American Cancer Society, it is very easy to get started.

Visit the US Jaycees Relay for Life Page

- Click on Find a Relay, and search by zip code or City and State to find the RFL that your team wishes to participate in.

- Once you have found your event, click on the blue “event website” link

- Select Sign Up

- Select Start a Team

- Enter your Team Name. Please Use your Chapter Name and two-letter state code in your team name (Example “Your City, State Jaycees”)

- Next, VERY IMPORTANT STEP, Click the Team/Company Organization Dropdown box, scroll down and select JAYCEES

- Continue through the registration process….and save. In order for your team to show immediately on the USJC/RFL website, please make a minimum of a $10.00 donation. (Even though your team is registered it will not show online until your first online donation is received)

- Please make a print screen of your registration confirmation, for future reference if needed.

You are now registered to FIGHT BACK with ACS and the US Jaycees. Your team will be viewable through your local RFL event website and on the US Jaycees/RFL Non-Corporate Team Page. The best part…..no additional reporting is required for US Jaycees, all online donations are tracked automatically through the website. Offline donations are also reported to your USJC RFL Program Manager on a regular basis. Of course, teams are encouraged to verify their information from time to time and report any discrepancies or ask any questions…anytime!

The next step…encourage your team members to go online and register too. Follow the same steps but select, join a team.

You can fundraise directly through your team site, team members can email friends and family, personalize their individual pages, and share their fundraising efforts with their Facebook Friends.

Banners will be available this year on a limited basis and will be available for teams who are registered on the USJC/RFL website and are actively fundraising only. These banners are recyclable and are the same as last year. If your team already has a banner and it is in good condition, please do not request a new one.

Please be sure to take photos at your Relay Fundraisers and Events. Photos and stories can be submitted to your USJC Relay PM. Chapters are also encouraged to submit their stories to the US Jaycees Magazine.

If you have questions or would like more information please contact 2011 Relay For Life Program Manager Angie Collins.

The US Jaycees are committed to FIGHTING BACK alongside the American Cancer Society. We ARE making a difference and saving lives together.

Outstanding Young Farmer

The roots of the Outstanding Young Farmer (OYF) program date back to the founding of The U.S. Junior Chamber. In 1920, in his first speech as National President, founder Henry Giessenbier stated that one of two national concerns on which the Junior Chamber should focus its attention was the improvement of conditions for the farmer and better urban-rural relations through a keener understanding of agricultural problems.

In 1951, Jaycee Dale Spears, of Shenandoah, Iowa, put Giessenbier’s challenge into action in designing a program to honor Shenandoah’s Outstanding Young Farmers. It was soon conducted as a statewide program by the Iowa Junior Chamber and, in 1954, was adopted by The U.S. Junior Chamber as a national priority program.

Today’s farmer is an entrepreneur in a complex agribusiness. He or she must understand all aspects of farming, including technology, farm implements, and other equipment used in today’s operations. He or she must also comprehend the complexities of fertilizer and insecticide to raise the high volume and quality crops demanded by consumers worldwide, while not running afoul of expanding environmental regulations.

As the farmer’s business has changed, so has his or her involvement in the community. Today’s farmer has become an active citizen, participating in everything from local and state government to civic groups and charitable organizations. It is not only fitting that farmers be honored for their contributions and achievements – it is essential.

The purpose of the Outstanding Young Farmer program is to bring about a greater interest in the farmer, to foster better urban-rural relations through the understanding of the farmers’ problems, to develop an appreciation of their contributions and achievements, and to inform the agribusiness community of the growing urban awareness of farmers’ importance and impact on the American economy.

Sponsors

John Deere is the national sponsor for the Outstanding Young Farmer program. This partnership began in 1976, and as a result, the program has been able to continue with its purpose. Perhaps some of the most valuable resources in conducting a successful OYF program are the supporters of the national OYF program. Supporting this program are members of the Outstanding Farmers of America (OFA) fraternity, which is comprised of former state OYF winners who are interested in the continuance of this program. Also, supporting the program are members of the National Association of County Agricultural Agents (NACAA). The United States Junior Chamber (Jaycees) administers the program throughout the year and culminating with the presentation of the national awards in the early spring.